It’s an exciting time in the world of trading. After a long period where transactions would typically settle in two days, we’re rapidly moving to same-day settlement and, in some financial markets, instantaneous settlement. In the capital markets jargon, this is known as T+0.

But what is “settlement”, why is this important, and how does reducing the time to settle affect your organization?

What is settlement?

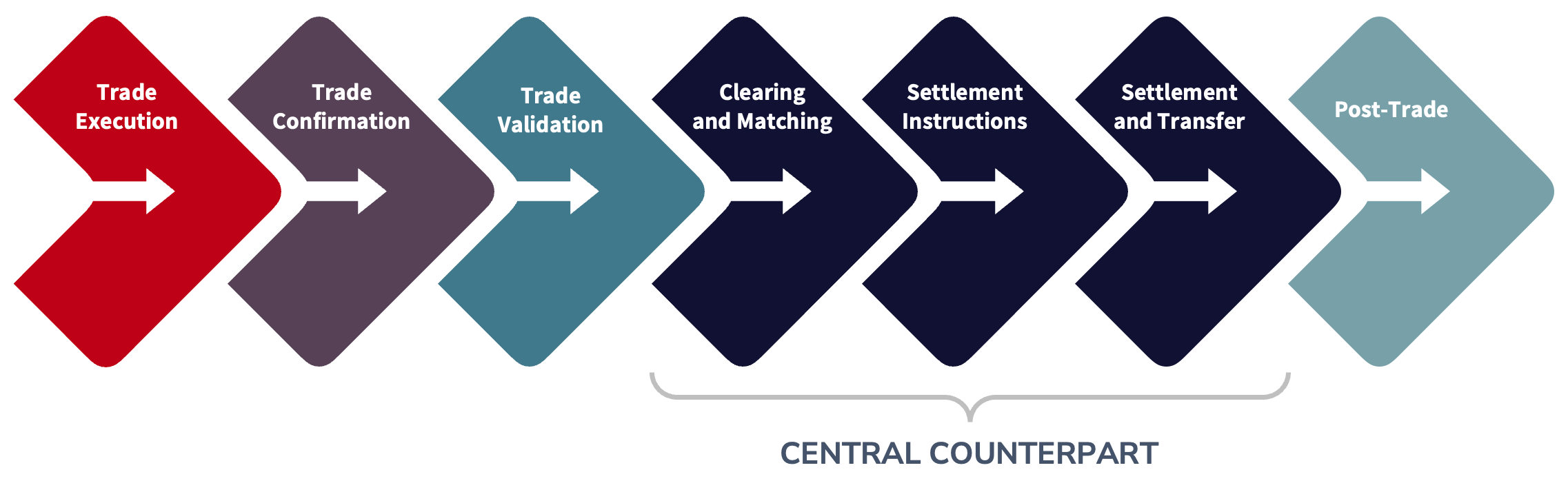

Settlement is a deceptively complicated process. Most of us are familiar with the first step, with the other stages typically happening behind the scenes. Here are the stages required to settle a typical trade:

- Execution. The trade is executed on the trading platform.

- Confirmation. Both parties confirm the trade details.

- Validation. The trade is validated for accuracy.

- Clearing and Matching. Trades are matched and prepared for settlement.

- Settlement instruction. Instructions for fund and security transfers are generated.

- Transfer. Funds and securities are transferred between parties.

- Post-settlement. Records are updated, reflecting the new positions and performing risk calculations.

In short, multiple layers of checks are performed before we pass the details on to a central counterparty, which actually transfers the funds and securities.

Once the settlement and transfer are complete, we need to update our records. The updates might be relatively simple, such as updating our positions to reflect the new trade or complex risk calculations.

Gradually…

As with so many significant changes, we don’t see them coming at first, or they seem distant and irrelevant. While the shift from T+2 has not yet touched most American and European exchanges, it is already a reality further east.

The Securities and Exchange Board of India (SEBI) moved to T+1 in 2023. The National Stock Exchange of India started beta testing T+0 in early 2024, with a limited set of twenty-five stocks settling at the end of the same day. The goal is to leave the beta program by the end of the year and then move to instant settlement a year after that.

And for some asset classes, China is already on T+0.

…and then suddenly

Meanwhile, the Securities and Exchange Commission (SEC), which regulates the industry in the US, has adopted T+1 starting in late May 2024. To remain internationally competitive, they are bound to move to same-day settlement in the next few years.

The UK, Canada, and other markets are likely to follow suit, though no timing announcements have been made at the time of writing.

As more and more markets move towards next-day and same-day settlement, the pressure on others to do the same will be immense. Within a few years, it is likely to be the standard.

Preparing for the change

The advantages of this change are immediately apparent to traders. When you sell a security, you receive your funds almost instantly. This instantaneous liquidity means that money can immediately be reinvested; that much is obvious. But more importantly, the sooner the trade settlement happens, the less exposure there is to various types of risk, including counterparty or broker risk, interest rate risk, and currency risk.

This is where “exciting” starts to become “daunting.” All the stages in settling a trade above must be performed more quickly. Activities that previously could be performed overnight may now need completing during the trading day. An example of this complexity is in quantifying risk. Historically, risk has been calculated in large overnight batch jobs, but will that be sufficient when trades settle immediately? Can you process all the trades quickly enough and scale as volumes increase?

Risk is just one of many internal systems that typically assume processing can be performed in batch, hours, or days after the event. Front office systems may need to deal with higher volumes of data during the trading day. The turn-around time for validation and confirmation systems, calculating fees and tax liabilities, and other actions throughout a trade lifecycle are all reduced. Moving from T+2 to T+1 challenges some of those assumptions. Moving to T+0 or instantaneous breaks them!

From batch to real-time

In technical terms, we’re moving from a world where real-time event processing has been a nice-to-have to an absolute necessity. Transitioning from batch systems to real-time is a challenge, and a crucial part of solving that challenge is realizing that your existing tooling may not be up to the task.

Real-time trade settlement needs technology optimized for real-time processing. GridGain’s Unified Real-Time Data Platform can provide just this foundation.

GridGain’s combination of real-time processing, in-memory performance, horizontal scalability, and advanced persistence functionality makes it uniquely suitable for these use cases. While other technologies can perform some of these operations, combining them in one platform has several advantages.

By avoiding data movement – a process we call co-location – and storing the most frequently used data in memory, GridGain can achieve substantial performance increases over competing technologies. GridGain can work in real-time, batch, or both by combining an event-driven architecture with persistent storage, simplifying migration from T+2 to the new world of T+0.

Competing architectures typically require integrating a few different systems. These integrations need to be developed, deployed, and supported in the long term. Your engineering and operations teams must be experts in multiple technologies, and your commercial teams need to negotiate support contracts with numerous vendors.

The performance or simplification can be compelling arguments individually, but combined, we believe nothing comparable exists on the market today.

Conclusion

The era of real-time settlement is approaching faster than anticipated. GridGain’s Unified Real-Time Data Platform can be the cornerstone of your transition to T+0 settlement, ensuring your organization stays ahead in this rapidly evolving landscape. Prepare now to embrace the future of trading with GridGain.